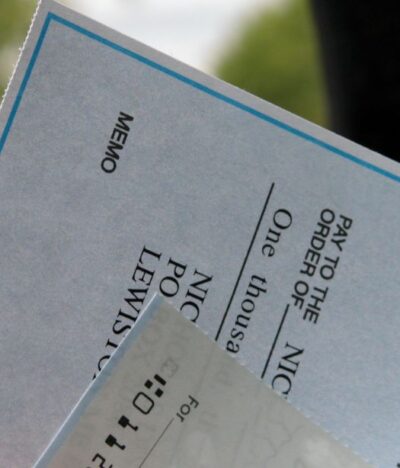

Recently, a commercial tenant came to me concerned about a landlord having the nerve to charge sales tax on his share of electricity. It seems incredible but the landlord did exactly what the law requires as commercial lease lawyers will tell you. Tenants must pay sales tax on common area maintenance charges (“CAM”) required by their lease. The landlord meanwhile has an obligation to remit collected sales tax to the Florida Department of Revenue (“DOR”) or face criminal charges.

If you think the DOR is not serious, consider they have increased the number of sales tax audits focused on commercial lease agreements of restaurants and retail businesses. If a tenant cannot prove sales tax was paid to the landlord, the tenant is directly liable to the DOR for all unpaid sales tax which includes interest and penalties.

Commercial Lease Lawyers Know The General Rule

Any payment made by the tenant for the right to use or occupy real property is subject to sales tax. This may include charges for ad valorem taxes (whether paid to the landlord or directly to the county tax collector’s office), common area maintenance, customer parking, building security, liability and casualty insurance, utility charges, lease deposits and lease termination charges applied towards rent, and janitorial service.

Less Obvious Sources of Sales Tax Liability

Not so obvious but known to commercial lease lawyers are building improvements creating liability for sales tax. If leasing vacant land, the landlord typically requires the tenant build improvements including the building to be occupied by the tenant. This also applies to any requirement to remodel an existing space.

The test on whether sales tax is due on amounts incurred by the tenant for improvements is whether the payments are required as part of the right to occupy the property. If the lease has expired and the tenant is no longer to be found, the landlord may be liable for use tax payments on the value of the improvements he keeps.

Another nuanced area typically covered with commercial lease lawyers is rental payments under commercial leases between related entities. For example, a retail business may operate as an s-corporation. Its principals may also own the land and building it pays rent on through a separate limited liability company for income tax and general liability purposes. Such rental payments are not exempt from sales tax. Rather, sales tax must be paid on rental payments between related entities.

Minimizing Sales Tax

For utility charges, landlords should consider a separate meter to the premises. If one is installed the tenant simply maintains its own account paying utility charges directly and sales tax is avoided. If installing the separate meter is a required improvement, see above.

If the lease ends with a termination payment and the landlord or tenant reports same as rental income or rental expense, sales tax liability may attach. You should consider defining any termination payment under the lease as consideration for a general release and to prohibit the tenant entering lease termination payments as rental expense.

Office and retail leases are like a business marriage. Commercial lease lawyers will help you navigate the pros and cons of your lease.