Buying a small business is an exciting venture that can offer significant opportunities for growth and financial success. However, it also comes with a number of legal complexities that must be addressed to ensure a smooth and successful transition. Whether you’re a seasoned entrepreneur or a first-time buyer, understanding the legal considerations involved in the purchase of a small business is essential.

If you’re looking to buy a business in Florida, it’s important to navigate state-specific laws and regulations, ensuring that you are fully protected throughout the transaction. In this post, we’ll explore some of the top legal considerations to keep in mind when purchasing a small business and why working with a lawyer is critical to the process.

1. Conduct Thorough Due Diligence

Before signing any agreements or committing to a purchase, conducting thorough due diligence is one of the most critical steps in the process of buying a business. Due diligence involves a comprehensive investigation of the business you intend to buy, including its financial performance, legal standing, and operational status.

This process is key to understanding what you’re actually getting in the purchase and helps you identify any potential risks or liabilities associated with the business. Key aspects of due diligence include:

- Financial Records: Review balance sheets, profit and loss statements, tax returns, and any debts or liabilities.

- Legal Compliance: Ensure the business complies with all applicable laws, including employment laws, environmental regulations, and zoning restrictions.

- Contracts and Agreements: Examine any existing contracts with suppliers, customers, or employees to ensure there are no hidden obligations.

- Licenses and Permits: Verify that the business holds all necessary licenses and permits to operate legally in Florida.

A lawyer can help guide you through the due diligence process, ensuring that all important aspects are reviewed and no critical information is overlooked.

2. Understand the Structure of the Purchase

When you buy a business, there are two primary ways to structure the purchase: an asset purchase or a stock/share purchase. Each structure has its own legal and financial implications, so it’s important to understand which option is best suited for your situation.

Asset Purchase

In an asset purchase, you buy the specific assets of the business—such as inventory, equipment, intellectual property, and customer lists—rather than the company itself. This option allows you to pick and choose which assets and liabilities you want to take on, potentially leaving behind any unwanted liabilities or debts.

Stock/Share Purchase

In a stock or share purchase, you buy the entire business, including both its assets and liabilities. This option typically requires more due diligence, as you’ll inherit all of the company’s obligations, including debts and legal claims.

Consulting with a lawyer experienced in buying a business in Florida will help you determine the best structure for your purchase and ensure that you understand the legal consequences of your decision.

3. Draft a Clear Purchase Agreement

The purchase agreement is the key legal document that outlines the terms and conditions of the sale. It is essential to have a well-drafted purchase agreement that clearly defines the expectations of both parties and protects your interests.

Some important components of a purchase agreement include:

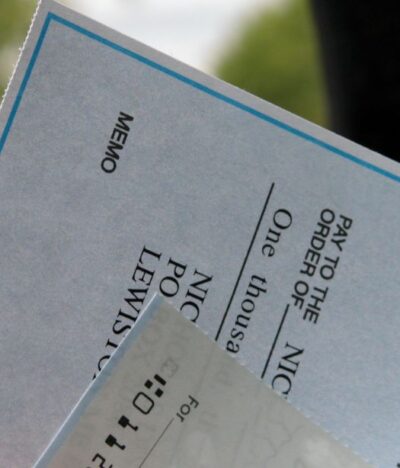

- Purchase Price: Clearly state the agreed-upon price for the business and how the payment will be made (e.g., lump sum, installments, or seller financing).

- Assets and Liabilities: Specify which assets and liabilities are included in the purchase. This is particularly important in asset purchases, where you may not be acquiring all of the company’s liabilities.

- Representations and Warranties: Both parties should make certain representations and warranties regarding the condition of the business, its assets, and its compliance with laws. These statements help protect against future claims or undisclosed liabilities.

- Non-Compete Clauses: To prevent the seller from starting a competing business in the same market, a non-compete clause can be included to protect your investment.

- Closing Conditions: Outline any conditions that must be met before the purchase is finalized, such as securing financing, obtaining licenses, or completing due diligence.

Having a lawyer draft or review the purchase agreement ensures that all legal aspects are covered and that the agreement is enforceable under Florida law.

4. Address Employment and Labor Considerations

If the business you’re purchasing has employees, there are important legal considerations regarding employment and labor laws. As the new owner, you will need to decide whether to retain the current employees or hire new ones, and how to handle existing employment contracts or benefits.

Some key employment considerations include:

- Employment Contracts: Review any existing employment contracts or agreements to determine if they can be transferred to you as the new owner or if new contracts will need to be drafted.

- Wages and Benefits: Ensure that the business complies with Florida labor laws, including minimum wage, overtime, and employee benefits.

- Unions and Collective Bargaining: If the business has a unionized workforce, you’ll need to understand the terms of any collective bargaining agreements and how they affect your ownership.

- Non-Disclosure and Non-Compete Agreements: If the business has sensitive intellectual property or trade secrets, ensure that employees are bound by non-disclosure agreements, and consider implementing non-compete clauses to protect the business after the sale.

Navigating employment laws can be complex, so it’s advisable to consult a lawyer experienced in Florida labor laws to ensure compliance and protect your business from future disputes.

5. Obtain the Necessary Licenses and Permits

Every business is subject to various licenses and permits that allow it to operate legally. When buying a business in Florida, it’s crucial to ensure that all required licenses and permits are in place. Depending on the type of business, this could include health permits, zoning approvals, alcohol licenses, and more.

In some cases, licenses and permits can be transferred from the seller to the buyer, but in others, you may need to apply for new licenses. Your lawyer can help identify which licenses and permits are needed and ensure that they are obtained before the sale is finalized.

6. Consider the Tax Implications

The purchase of a small business can have significant tax implications, both for the buyer and the seller. The structure of the sale (asset vs. stock purchase), the business‘s legal entity type, and the nature of the transaction can all impact your tax liability.

For example, in an asset purchase, you may be able to allocate part of the purchase price to different assets, which could offer tax advantages such as depreciation. Consulting a tax advisor or lawyer with experience in Florida business transactions can help you structure the purchase to minimize tax liability and maximize benefits.

Schedule Your Free Legal Consultation with Eko Law Today

Buying a business in Florida involves navigating numerous legal considerations, from due diligence and contract negotiations to employment and licensing matters. Whether you’re a first-time buyer or an experienced entrepreneur, working with an experienced lawyer is critical to ensuring that the purchase goes smoothly and that your interests are protected.

By understanding the legal aspects of the transaction and taking the time to address potential risks, you can make informed decisions and set your new business up for long-term success.

Schedule your free legal consultation today and embark on a journey towards successful, legally sound business transactions.

Contact us now to discover how Eko Law can be the key to unlocking your business’s full potential.